The COVID-19 pandemic has had a significant impact on various industries, including the diaper machine industry. Stringent lockdowns and travel restrictions imposed by regulatory agencies worldwide disrupted supply chains, affecting the importation of essential equipment and materials. Additionally, adherence to social distancing measures resulted in reduced workforce capacity, leading to decreased output rates in the sector.

Automatic diaper machines are driving growth in the global market, primarily due to their revenue generation capabilities. These machines, whether fully automated or semi-automated, streamline the manufacturing process of infant diapers, offering increased efficiency compared to manual labor. Fully automated diaper machines can perform cutting, molding, and packaging processes seamlessly, producing consistent output with minimal defects in a shorter timeframe. In contrast, semi-automated machines require labor intervention for the assembly of baby diapers, leading to slower order fulfillment and reduced efficiency.

Overall, the expansion of the diaper machine market is propelled by the demand for automated solutions that enhance productivity and streamline manufacturing processes in the production of infant diapers.

As the demand for diapers continues to rise, the pull-up design emerges as the leading segment in the global market. This design, known for its simplicity and comfort, has dominated both the baby and adult diaper markets for over a decade. Its effectiveness lies in promoting close contact between the absorbent material and the wearer, reducing leakage and ensuring optimal dryness. Additionally, the pull-up design offers ease of use, resembling underwear rather than traditional diapers, particularly appealing to the geriatric population.

In the global diaper machine market, output capacities exceeding 1000 units per minute capture the largest market share. Diapers, typically composed of wood pulp, paper, and plastic, have a long shelf life, with manufacturers recommending a two-year expiry period. Given the product's longevity and the importance of maintaining a steady supply, higher output capacities are preferred. This not only meets consumer demand but also allows manufacturers to benefit from economies of scale, reducing production costs and enhancing profitability.

Europe is poised to dominate the diaper machine market growth, with significant investments in new manufacturing facilities. For instance, Biosphere Corporation opened a diaper manufacturing factory in Ukraine, projecting a monthly output of 18,000,000 diapers. Similarly, Asia Pacific is witnessing rapid growth, with companies like Nobel Hygiene Pvt Ltd. expanding production facilities to meet increasing demand. As the global population grows and more infants are born, the need for baby diaper machines is expected to escalate, driving market expansion.

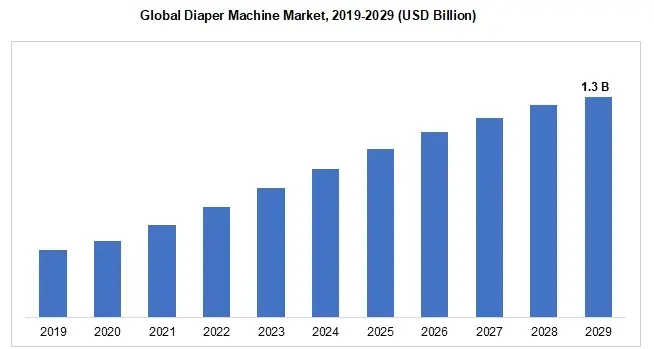

From 2021 to 2029, the worldwide baby diaper machine market is forecasted to grow at a CAGR of 4.6%, reaching USD 1.3 billion by 2029. This growth is fueled by various factors, including the rising number of nuclear families, working women seeking convenient infant care solutions, and the increasing prevalence of adult incontinence conditions. As the population ages and the incidence of diseases such as diarrhoea and dementia rises, demand for underpads, diapers, and other related products is expected to surge.

The market's growth is further propelled by the growing demand for stress urinary products among women. With approximately one in three women experiencing stress urinary incontinence, the adoption of urine diapers is on the rise, with an anticipated increase to 28.4 million users in the United States by 2050. Overall, the global diaper machine market is expected to flourish, driven by demographic trends, evolving consumer preferences, and advancements in healthcare.

However, the substantial costs associated with baby diaper machines and fluctuations in raw material prices are anticipated to impede market expansion. Nonetheless, technological advancements present promising opportunities for market development. The demand for diaper packaging machines is expected to increase as the market seeks more modern production technologies. Economic constraints, such as the high cost of diapers, lead to market concentration among a few major competitors. Moreover, market instability in raw material sales and import taxes further restrict market growth.

According to the World Health Organization (WHO), approximately 140 million women give birth every year. With increased birth rates, India and China are projected to drive significant demand for diapers, contributing to the momentum of the diaper machine market in the coming years. China alone recorded 14.65 million births in 2019. Additionally, the Asia Pacific region, fueled by rising numbers of employed women and disposable income, accounts for a substantial portion of global infant diaper sales.

Furthermore, the growing acceptance of adult diapers due to the rising prevalence of bladder-related health conditions among the elderly is expected to drive adoption throughout the forecast period. The WHO predicts that the global population of individuals over 60 will reach 2 billion by 2050, with low- and middle-income countries comprising over 80% of this demographic. In Japan, 30% of the population is aged 60 or above. Adult diapers play a crucial role in maintaining hygiene and providing care for the elderly experiencing bladder leakage due to weakened bladder and pelvic muscles. The widespread availability of various brands and expanded distribution systems has also contributed to the global rise in diaper adoption. Consequently, the diaper machine industry is expanding at a faster pace than the demand for diapers.